Earning Interest in a Decentralised World

Banks pay interest on savings to encourage people to deposit their money. The bank then invests and grow these deposits in a range of financial instruments such as government bonds, stocks, real-estate, and loans to individuals and businesses. Profits are then paid to shareholders. This process is fundamental in providing liquidity to our centralised financial system.

With cryptocurrency, many of the same principles apply but they operate in a decentralised system that places more emphasis on rewarding the customer and not the shareholder. Deposits can be invested in a range of financial services and applications that help support the crypto eco-system in return for interest. From the simple staking of stablecoins to yield farming to liquid staking of a particular crypto token, there are many opportunities that vary in complexity, risk, and reward.

Why use crypto earning strategies over traditional methods

The balance between risk and reward should be evaluated for any financial investment or decision. Whether it’s taking out a loan for home improvement or investing in stocks and shares, each decision is determined by a person’s unique circumstances and appetite for risk and reward.

Cryptocurrency is a key part of a new technologically disruptive wave of decentralised financial applications and services that are being offered to users. These services are often run autonomously; they are in essence bits of code on the internet that execute tasks and fulfil requirements 24/7 as configured by the protocol. This movement is referred to as Defi.

With Defi applications and services, whilst the risk should always be evaluated, the rewards are often greater because there are no expensive middle-men taking a cut, no buildings and staff to maintain, no debt to service or shareholders to consider. Instead, services are automated through the use of Smart Contracts, i.e., computer code programmed to fulfil an agreed purpose or contract.

As crypto comes more into the mainstream so the regulation increases to support the industry. Currently, the crypto industry remains largely unregulated so there are minimal protections available for consumers and this needs to be considered before any investment is made. That said, armed with some knowledge about the opportunities available, and more importantly the pitfalls to avoid, it is possible to earn very good returns on cryptocurrency in a safe and consistent manner.

Consider the hypothetical scenario whereby you find £5,000 down the back of the sofa. At the time of writing (February 2023), a non-home owner would have the following options:

typical High Street Bank Account

Pros:

5% on up to £1500 (0% above)

Cons:

Minimal monthly pay-in £1000

Often have to sign up for multiple accounts.

Often a monthly account fee

Only applicable for 1 year.

Return After 1 Year =

£75

typical CASH ISA

Pros:

3.05% on £5000

Cons:

Money often fixed with all sorts of caveats and penalties on withdrawals and transfers.

Return After 1 Year = £152

low risk Crypto subscription

Pros:

6% > £0-£1000

3.6% >£1000+

Can withdraw anytime

Cons:

None

Return After 1 Year =

£200

THE BASICS

Many of the income strategies described on this page require you to have a basic understanding of cryptocurrency and to of set yourself up with an account on a major exchange and/ or a crypto wallet.

Please check out the guides below to help you on your way.

income strategies

Here is our detailed guide to some DeFi strategies that can earn interest on your cryptocurrency.

Stablecoin Staking

This involves depositing your stablecoin cryptocurrency to an Exchange in return for interest. Staked amounts vary in duration, flexibility and interest accrued.

Non-stablecoin Staking

Much like stablecoin staking but involves depositing alternative cryptocurrencies on an Exchange or defi application.

Yield Farming

Yield farming is the method of depositing your cryptocurrency into a pool with other crypto users. The deposited funds are used by smart contracts in the Defi space that carry out specific tasks, e.g., borrowing & lending. Interest is paid as a reward for supporting the protocol.

Liquid Staking

Liquid staking allows for deposited funds to be reused and not locked into a particular protocol.

Self Repaying Loans

With the self-repaying loan you borrow against your deposited cryptocurrency. Your deposited amount is then set to work earning yield by a smart contract which pays off your loan automatically.

Simple Staking Solution

One of the more straight-forward strategies to earn interest on your money is to convert it into a crypto stablecoin and stake/subscribe to a crypto Savings Product. The APY that these Saving Products yield varies according to the stablecoin used and the length of time you sign up for. Binance offers a user-friendly and safe option for beginners and is described below.

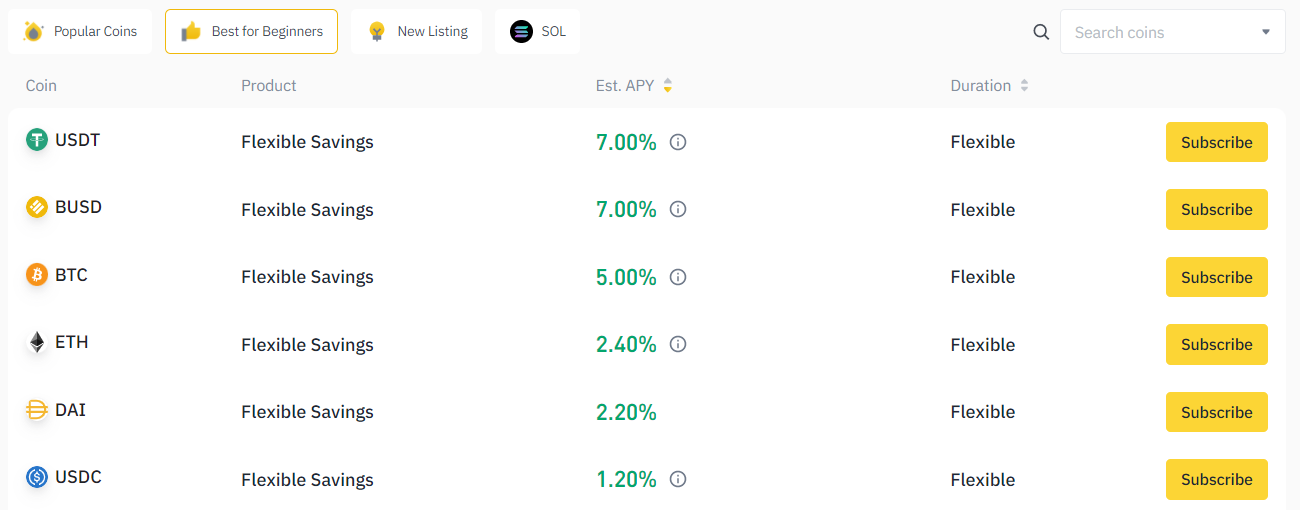

NAVIGATE TO THE BINANCE EARN MENU OPTION

Select the Best for Beginners option and you will see a list of crypto Products sorted by the Est APY.

The screenshot below shows an example where the top record states that the USDT coin offers 7% interest and is a Flexible Savings product – flexible means you can withdraw it anytime.

There are Savings Products that have a lock period (typically 15, 30, 60 days) that offer higher APY.

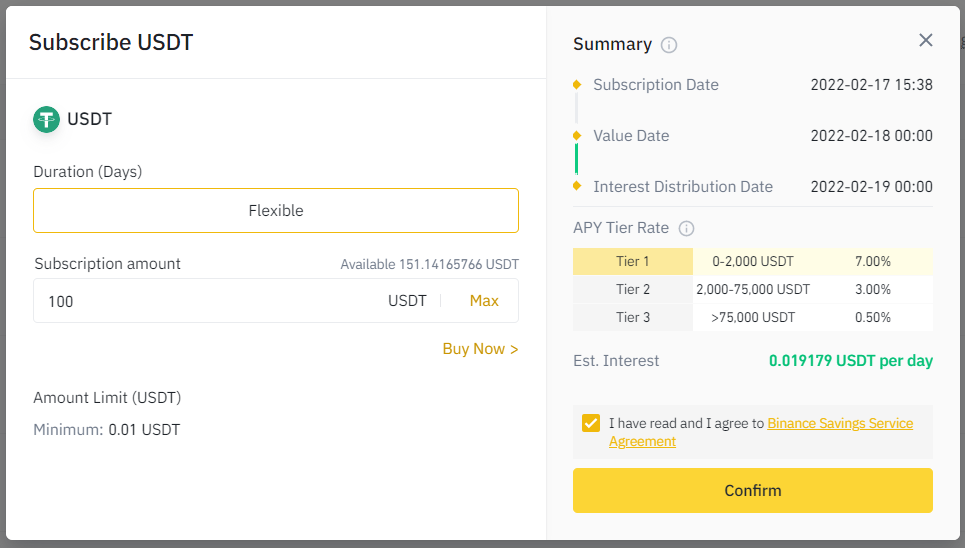

CLICK SUBSCRIBE

The Subscribe box will appear outlining your intended subscription to this Saving Product.

Enter the amount of USDT that you wish to use in the Subscription Amount. The app will calculate the Est. Interest that you will earn per day.

Click the checkbox to state you have read T&Cs and then click Confirm.

That is it. You are now earning 7% APY on your USDT which can be withdrawn and/or converted back to your local currency anytime.

Complexity

Minimal. Requires you to of registered with and deposited funds on a crypto exchange.

Rewards

Stable interest rewards at a fixed rate.

Risks

Minimal.

Non-Stablecoin Staking

This method of staking involves subscribing to a product with a crypto coin or token that is not tied to a fiat currency. This type of staking is traditionally used to secure a network and/ or provide consensus to the transactions taking place on the blockchain. For example, well known cryptocurrencies such as Bitcoin and Ethereum can be staked in return for rewards.

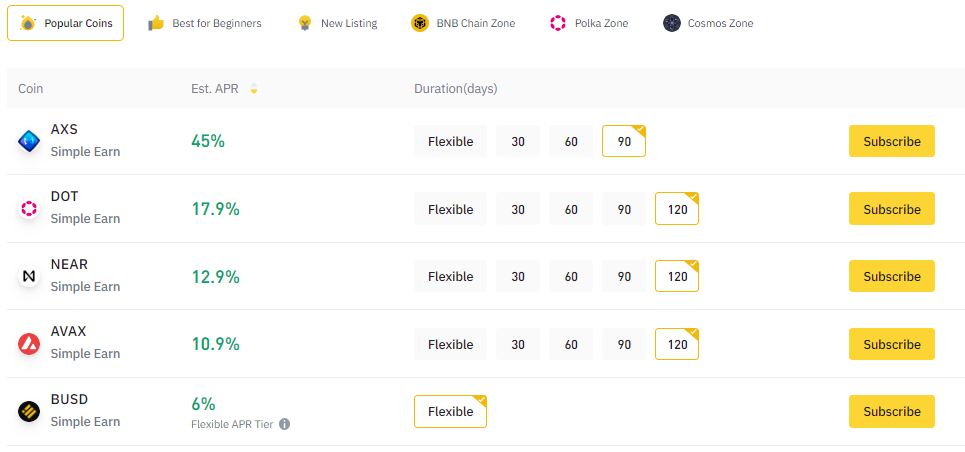

NAVIGATE TO THE BINANCE EARN MENU OPTION

Select the Popular Coins option and you will see a list of crypto Products sorted by the Est APR. Each product offers a specific APR based upon the duration for which you are subscribed.

The screenshot below shows an example where the top row states that the AXS coin offers 45% interest when it is staked for 90days. The longer the duration the higher the APR. Enticing APR numbers should be weighed against the need for flexibility and the potential for the coin in question to fall in price value.

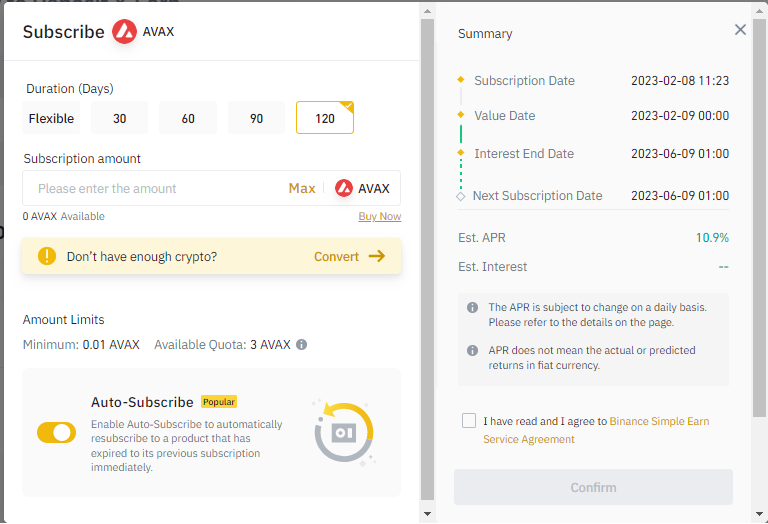

to subscribe to a product click the subscribe button

The Subscribe box will appear outlining your intended subscription to this Saving Product.

Enter the amount that you wish to use in the Subscription Amount. For altcoin subscriptions there is often a quota or limit as to how much one can stake.

The app will calculate the Est. Interest that you will earn per day for the duration of the subscription.

Click the checkbox to state you have read T&Cs and then click Confirm.

After confirmation, your cryptocurrency will be subscribed for the duration selected and you will accrue interest during that time. It is possible to cancel your subscription before the duration completes by incurring a small penalty.

Complexity

Requires some knowledge of alternative cryptocurrencies.

Rewards

Often increased staking rewards than with stablecoins.

Risks

The cryptocurrency that you are subscribed to is not stable and could go up or down.

Liquid staking

With traditional/ simple staking methods, when a user deposits a crypto asset (stablecoin or non-stablecoin) into a staking pool or subscribes to a Savings Product in return for a staking reward or interest, those assets are locked for

a duration of time and cannot be used elsewhere. Much like an investment in a cash ISA, the money is locked in the savings account and cannot be used to fund a purchase or alternative investment.

The concept of Liquid Staking determines that when a user deposits a crypto asset for staking they receive a cryptocurrency asset in return that can be utilised elsewhere in the crypto eco-system.

heading

There are many DEFI apps and protocols that offer Liquid Staking services. When deciding which service to utilise a useful metric is the amount of staked assets already under their control. This can easily be identified using the dashboard here and the TVL metric which stands for Total Value Locked. At time of writing, LIDO is the largest provider for Liquid Staking with over $8 billion worth of Ethereum locked under their protocol.

Liquid Staking with lido

The Subscribe box

Complexity

Medium. You need to register a crypto wallet and transfer funds from an exchange account.

Rewards

Usually stable rewards

Risks

The underlying asset may change in price..

Self-Repaying Loans

In a typical loan scenario, you would make an application for a loan which would be judged by the loan provider and if successful you would commit to paying interest to service the debt and any assets you have may be at risk if the debt

repayment isn’t met.

The self-repaying loan is an innovative product within the DeFi movement that allows you to deposit your crypto into a smart contract and then use that as collateral to take out a loan up to a specific percentage of your deposited

amount. The smart contract is programmed to earn yield on your deposit and automatically pay off the loan.

For example, you could deposit £100 of USDT cryptocurrency into the smart contract in return for a £50 loan. Whilst your £100 is deposited, the £50 loan is automatically paid off and at the end of the contract terms you get your £100

back.

Heading

- Navigate to the Alchemix.fi website and connect your wallet (at time of writing Alchemix does not support MetaMask so you will need to use an alternative wallet. The process for wallet set up is very similar to the MetaMask wallet setup.

to subscribe to a product click the subscribe button

T

Complexity

Requires some knowledge of alternative cryptocurrencies.

Rewards

Often increased staking rewards than with stablecoins.

Risks

The cryptocurrency that you are subscribed to is not stable and could go up or down.